October 09, 2019

If you are already making on-time payments on your loans and credit cards, you are on your way to a better credit score. In fact, you may see your scores rise a bit each month as you establish a good payment history. If you are rebuilding credit, or are ready to take your credit score to the next level, it’s important to understand how the FICO credit scoring system sees your “mix” of credit.

FICO wants to see a variety of credit products on your credit report. It’s still more important to pay all your bills on time and limit spending with credit, but your credit mix pays a role in creating a great credit score.

FICO wants to see a variety of credit products on your credit report. It’s still more important to pay all your bills on time and limit spending with credit, but your credit mix pays a role in creating a great credit score.

Here are the scoring criteria FICO uses to determine your score:

- You pay your bills on time, every time

- You owe a total of less than 30% of your total available credit on revolving accounts (this is your credit utilization ratio)

- You’ve had credit established for many years

- You haven’t opened very many new accounts in the past 12 months

- You have a mix of accounts on your credit report

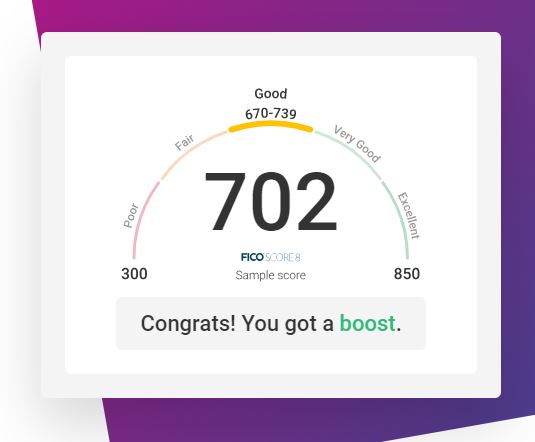

Remember, opening many new accounts at once may cause your score to drop. If you already have a credit card, a store card, and a gas card, adding a small installment loan with payment terms that fit into your monthly budget may give your score a boost.

Here are the types of credit the FICO scoring model takes into consideration when determining whether you have a good mix of credit products in your file:

- Retail store/gas credit cards

- Bank credit cards

- Installment loans

- Auto loans

- Mortgages

- Student loans

While it isn’t necessary to have every type of credit product in your file to maintain or build a good FICO credit score, it does help to have a variety.

So, how can you use this information to make good choices when you need to borrow money? If you need extra cash to cover seasonal or unexpected expenses, consider taking out an installment loan instead of maxing out credit cards.

With payments that are equal for a set term, an installment loan helps preserve your credit utilization ratio while adding a positive mix of credit products to your file.

For more great information on all things credit-related, head to our 'Basics of Credit' reference page.

Related Posts

June 16, 2017

May 08, 2023