February 20, 2018

Depending on your current financial and credit situation, a personal installment loan could help boost your credit score by adding diversity to your credit accounts and by creating a history of on-time payments.

How credit account diversity helps your credit score

Approximately 10% of your FICO and VantageScore credit score is determined by your "credit mix" according to Experian.

Approximately 10% of your FICO and VantageScore credit score is determined by your "credit mix" according to Experian.

Having a variety of loans and revolving credit account shows potential lenders that you can handle different types of credit. For example, if you have only credit cards in your credit file, adding a personal installment loan will add diversity. Ideally, you'll have a mix of revolving and installment credit.

How on-time payments help your credit score

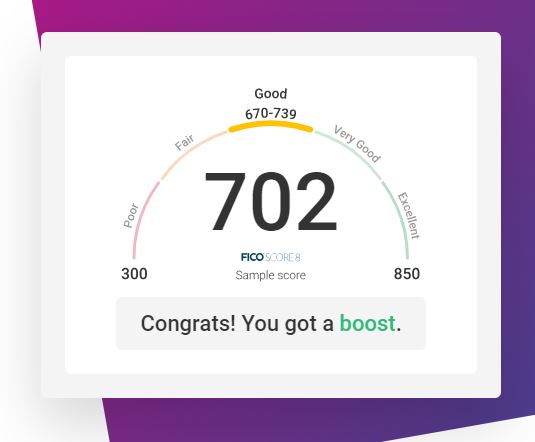

Your payment history is the part of your credit score with the largest effect on your overall credit health and making on-time payments every month is the most reliable way to boost your score.

Adding a personal installment loan to your credit file offers the opportunity to demonstrate that you can and will make every payment on time. To do this, it's crucial that you make sure the monthly payments fit into your existing budget without adding financial strain. Using a personal installment loan to pay off credit cards could also boost your credit score.

Another large portion of your credit score is determined by your credit utilization. Ideally, you would keep all balances on revolving accounts like credit cards and store-branded cards under 30% of the total available credit from month-to-month. If your credit cards and store card balances are more than about 1/3 of your total available credit, you can improve your credit utilization by taking out a personal installment loan to pay off credit card balances. It's crucial to leave those accounts open. Closing accounts reduces the total amount of available credit, which won't help your credit utilization ratio.

If the card has an annual fee, it may make sense to close the account. First, call the company and ask them if they'll waive the fee. Tell them you are considering paying off the card and cancelling the account to find out if they can offer you a better deal.

Some people can't resist the temptation to use credit cards, even after they take out a personal loan to pay off the balances. If you think you'll have problems leaving those accounts alone, destroy the physical cards. Be sure to cancel any recurring payments that are attached to the accounts, as well.

There are plenty of benefits to getting a personal installment loan. In many cases, a personal installment loan has a lower interest rate than credit cards. This could help you save money in the long run, while improving your credit file. Be sure to research your options carefully. Remember, credit files take at least 30 days to update, so adding an installment loan isn't a "quick fix" for your credit. It could help boost your score down the road, though.

Want to learn more about personal installment loans? Check out our blog post "Common Uses for Personal Installment Loans".

Related Posts

May 08, 2023

August 03, 2018