September 25, 2018

If you have a thin credit file or don’t have access to credit cards or loans, you might have difficulty building a good payment history. This could result in difficulties accessing other forms of credit, which can lead to a decline in your credit score. To help individuals rebuild their credit or “boost” their score, Experian recently launched Experian Boost. This article will guide you through how Experian Boost works and how you can benefit from it.

What is Experian Boost?

Experian Boost is a program that helps individuals build credit by analyzing their payment history for regular bills such as utilities, rent, and cell phone payments. These payments are typically not reported to credit bureaus, which can result in a thin credit file or low credit score. Experian Boost, therefore, offers a solution by enabling you to add these payments to your credit report, potentially boosting your credit score.

How Does Experian Boost Work?

To participate in Experian Boost, you need to create an account at Experian.com. The sign-up process requires your full legal name, address, phone number, email address, and social security number. Signing up for Experian is free, and it won’t affect your credit score.

Once you sign in, you’ll see a message asking if you want to upgrade to CreditWorks Premium. This step is not necessary to access Experian Boost. If you wish to proceed without the upgrade, click “No, Keep My Current Membership” to continue.

You can sign up for Experian Boost by clicking on the appropriate tab at the top of the page. You will then search for your bank and enter your bank login information to allow Experian access to your transaction records. The program will search for regular bills you pay and use them to establish a payment history to help you seem less risky to potential lenders.

If your bank isn’t listed, click the “I can’t find my bank” tab, and put in the name of your bank to let Experian know that you’d like to access the program. You’ll get a message saying they will look into adding your bank and they’ll let you know when they get the job done.

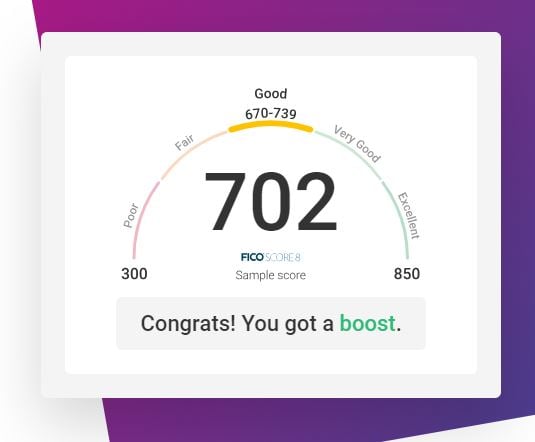

If your bank is listed, and you agree to participate in the program, you could see a boost to your Experian FICO 8 credit score immediately.

Benefits of Experian Boost

Experian Boost offers several benefits to individuals looking to improve their credit scores. These include:

-

Boosting Your Credit Score: By adding regular payments to your credit report, you can potentially increase your credit score.

-

Helping You Build Credit History: If you have a thin credit file, Experian Boost helps you build a credit history, making it easier to access credit in the future.

-

Free to Use: Signing up for Experian Boost is free, and it won’t affect your credit score.

Finding Local Loans with Sunset Finance

Sunset Finance offers a variety of personal loans to meet your financial needs. Whether you need to cover an unexpected expense, consolidate debt, or make a major purchase, Sunset Finance can help.

Our personal loans come with competitive interest rates to fit your budget. We also offer credit and budgeting resources to help you manage your finances and improve your credit. With multiple locations throughout South Carolina and Georgia, Sunset Finance makes it easy to get help when you need it.

Free Personal Finance Resources

If you would like more resources on personal finances and budgeting, check out these resources:

- For more great information on all things credit-related, head to our 'Basics of Credit' reference page.

- Read about How To Adjust Your Budget For Rising Prices

- Download our Free Simple Monthly Budgeting Worksheet

- Check out our online resource center for more budgeting basics and more

- Learning to manage a budget becomes a relatively simple task with a bit of practice. Take a look at The Basics of Budgeting to get started.

Related Posts

September 29, 2017

October 09, 2019