September 06, 2024

Becoming the victim of identity theft is one of most people’s worst nightmares. Therefore, discovering this scam as soon as possible is essential to avoiding large financial losses and avoiding long-term impacts on your credit.

Even though identity theft is highly prevalent, many people don't know they've become victims of this scam. We'll explain how to find out if you're a victim and the steps you should take after discovering to help ensure timely restoration of your credit, in the event you are.

Signs of ID theft

You should monitor your financial reports and information closely to look out for identity theft. Here are some red flags that something isn’t right.

- You see unknown charges on your credit card bill. Minor discrepancies can be a sign of fraud. If you don’t remember spending that amount at a retailer, go back to your receipts to check.

- You stop receiving credit card bills by mail or email. If you’ve selected paperless billing, you’re probably not accustomed to getting paper credit card statements. But what you might not know is that scam artists sometimes change the billing address for credit cards to learn more about you to steal your identity.

- You notice significant changes in your credit score. Large jumps should always be alarming in either direction.

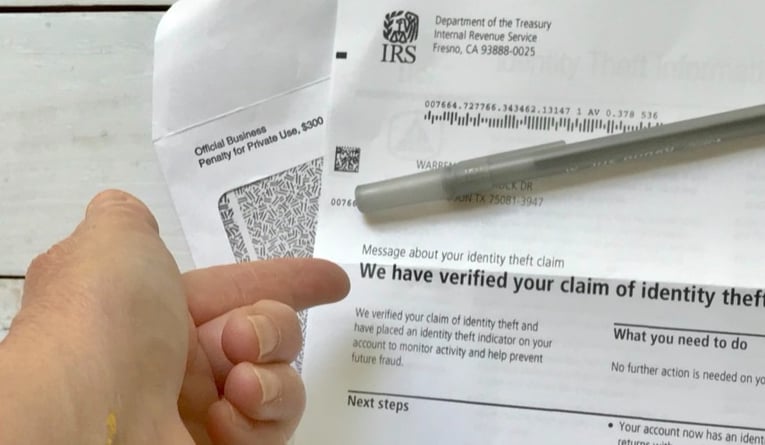

- Your tax return is rejected. One way scammers use your identity is to file a fraudulent tax return to claim your tax refund. A major sign of this is if your tax filing is rejected, which can be a sign that someone else filed a return under your name.

- Credit card companies or banks deny you a line of credit, yet you have good credit. This could be a sign that someone has taken out a line of credit in your name, or that you now have too many lines of credit due to the fraud.

- Your credit report shows a new line of credit you didn’t open. Fraudsters that get access to your personal information open a new line of credit against you and try to max out those credit cards before you discover the fraud.

- You’re charged for medical visits and procedures you didn’t undergo. Another way that people use your identity is to get access to your health benefits. They pose as you to get a procedure or medical care. Then you get mailed a bill or denied coverage due to outstanding bills you didn’t know you had.

- You start getting calls from debt collectors about accounts you have no knowledge of. In some cases, people don’t know about ID theft until much too late when the credit card company or bank turns over your information to debt collectors. That’s why it’s so important to monitor your credit carefully and set up alerts on your credit report to avoid unauthorized lines of credit.

What to do if you’re the victim of ID theft

If you experience any of the red flags listed above, you should act immediately to stop the fraud. Here’s a look at the steps you should take to avoid financial impacts and restore your credit.

- Contact the fraud department for companies where the fraud occurred. Explain that you're the victim of ID theft and that you need to close the account immediately. Ask for a letter confirming that the fraudulent account is now closed and that you aren't liable for the charges. You'll also want confirmation that the account won't show up on your credit report.

- Report the fraud to the Federal Trade Commission (FTC). Provide as much detail as you can to help the FTC locate and prosecute the individual who committed the fraudulent acts.

- File a local police report. Take a copy of your FTC ID theft report with you as well as proof of your identity and address. Explain that someone stole your identity and request that they file a report about it. Ask for a copy of the report for your records.

- Contact the three credit bureaus explaining that you were the victim of fraud and need to have items removed from your credit report. The FTC provides this helpful example letter and the contact information for the credit bureaus to make things simple.

- Change your usernames and passwords for sensitive accounts. Go through and carefully change this information for your bank accounts, loans, mortgage and any other sensitive accounts you want to avoid someone stealing. You don’t know just how much information the scammer has about you to continue the fraud.

Financial resources

Want to learn more about identity theft and how to protect yourself? Subscribe to email updates at the bottom of our blog page or contact us with any questions about how to protect your credit.

Related Posts

March 09, 2018

September 07, 2018